Award-winning PDF software

What is 1000? Form: What You Should Know

Form 1000 — Freddie Mac Single-Family Form will be completed on the basis that it will represent the property you are requesting a form for. (The form is for the sole purpose of determining the market rent for a property and will not be used to determine the rent for any other purposes. It is designed to provide the Form 1042 — U.S. Trust Fund or U.S. Individual Retirement Account Statement What is a trust fund in the United States? A trust fund is a fund established by a person, including a corporation, trust company, or the United States in order to invest or benefit as trustee all or some part of the net income or other assets of the trust. The only beneficiaries are those of the trust. Form 1090 — IRS Tax Return Where would a corporation report dividends to shareholders? The tax treatment for distribution to shareholders in respect of any corporation is determined in tax legislation, rules and regulations. When a corporation reports distributions of income to shareholders, it is the corporation making the distribution, and it may not report the distribution as an amount received before receiving the shareholder's adjusted gross income. Tax regulations are available from the IRS for this purpose. Form 1040 — U.S. Individual Income Tax Return If your corporation pays capital gains to shareholders, how do you report it on Schedule D? Capital gains are capital gains realized on the sale or exchange of an asset. Capital gains realized in the year on the sale or exchange of tangible property are reported on Form 1040 (Individual Income Tax Return). Capital gains realized in a later year are reported on Form 1041, U.S. Individual Capital Gains and Losses. Capital gains realized on a nonportfolio investment property that you sell within three years of disposing of the property are reported on Form 8822, Miscellaneous Business Income, but report them as a capital gain on Schedule D (Form 1040). Form 1043 — U.S. Estate Tax Return If you have a transfer to or from a U.S. trust, how much is taxable to the estate? If you have a transfer to or from any U.S. trust from or to a domestic trust, the portion of the property transferred that is subject to the estate tax is includible in the gross estate of the estate but not subject to any other estate or succession tax. (For more information check the FAQs on the U.S. estate tax here.) Form 1045 — U.S.

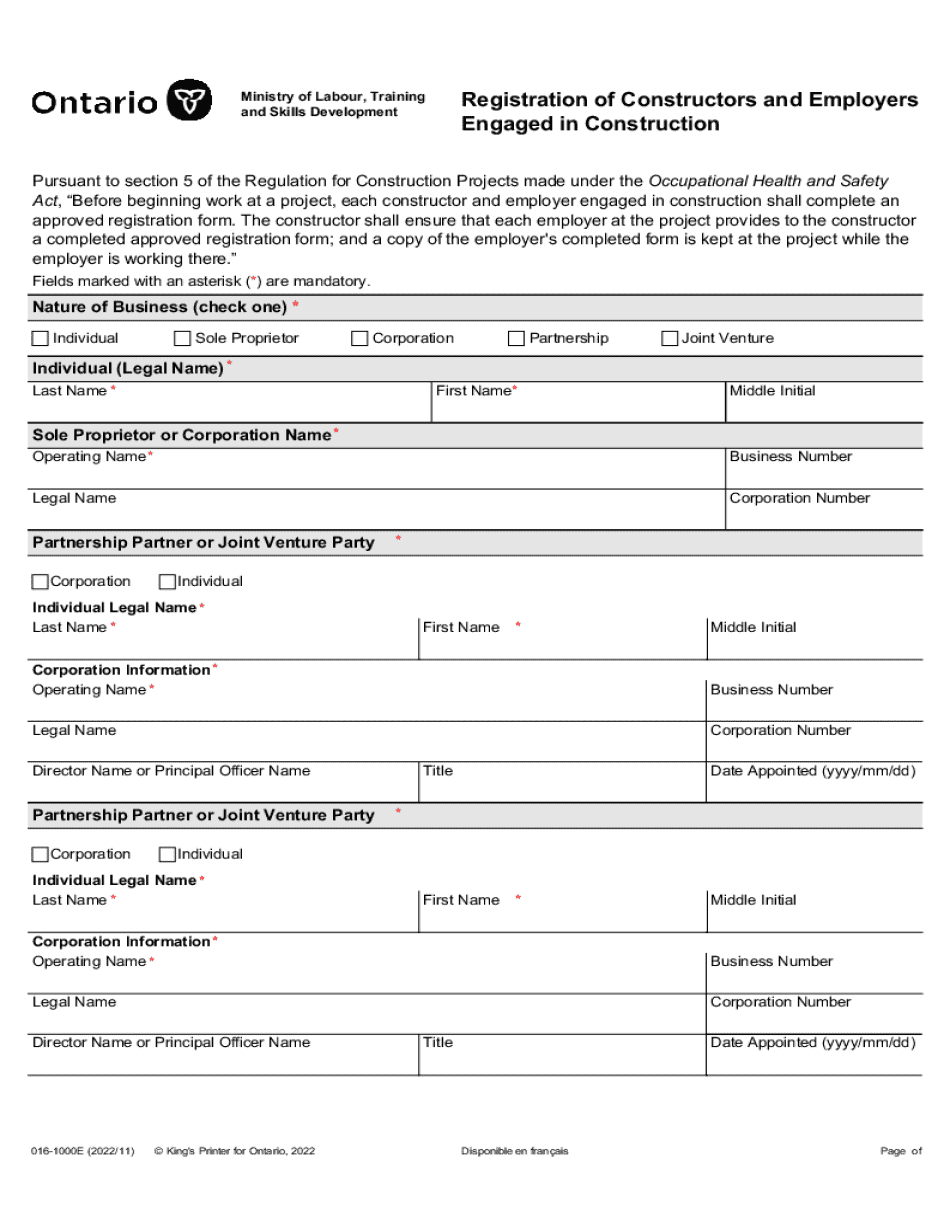

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Mol 1000, steer clear of blunders along with furnish it in a timely manner:

How to complete any Mol 1000 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Mol 1000 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Mol 1000 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.